In a corner office thick with the aroma of newly printed paper and ambitions unfulfilled, SoFi Technologies Inc., having recently paused to catch its breath (and secure a national bank charter, a hobby for some), now vows a grand return to crypto trading by year’s end. Their CEO, Anthony Noto—a man who probably polishes his optimism every morning—announced this development, no doubt while gazing out a foggy window and pondering the future of financial services, which he claims is being “completely reinvented.”

Will the world be able to stand such reinvention? One wonders.

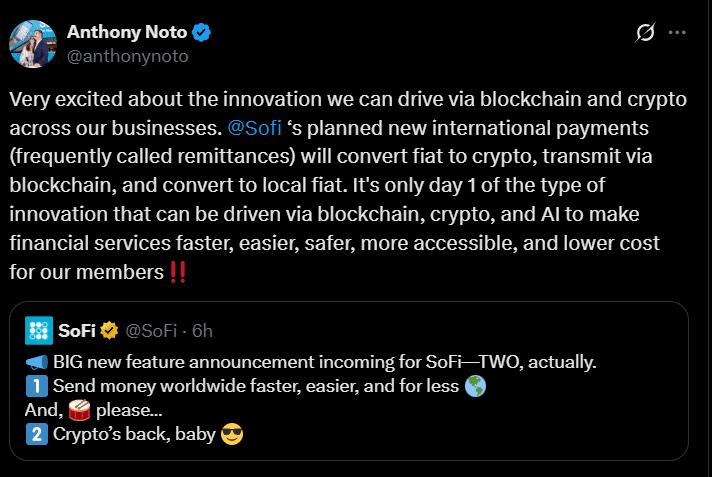

Noto assures us that crypto and blockchain will soon weave themselves through the very fabric of all SoFi’s businesses—maybe with the delicacy of a darning needle held by a nearsighted tailor. Buying, saving, investing, borrowing, paying, and “protecting.” (From what, he doesn’t say. Apparently not from volatility.)

You may recall, dear reader, that in late 2023 SoFi halted crypto services in order to comply with federal conditions—because nothing signals modern fintech prowess like telling customers, “Kindly take your crypto and try Blockchain.com instead, or sell it if you’d rather not play musical chairs.”

Now, the Office of the Comptroller of the Currency (no relation to Father Time, although just as capricious) has blessed SoFi’s re-entry like a priest waving incense over a blockchain. And SoFi is not content with simple trading—no, they are flirting with savings, lending, payments, and perhaps your grandmother’s insurance policy.

And—because why not borrow money that doesn’t even exist?—they plan to grant loans backed by crypto. “Stablecoins” too, which are digital coins tied to the real U.S. dollar and only slightly less stable than my uncle’s investment strategies.

The eager startup might launch these features in six to twenty-four months, or sooner if they impulsively acquire more companies. (Corporate shopping sprees: not just for the holidays.)

Meanwhile, SoFi boasts a banner year, with 800,000 new customers and $71 million in profit in the first quarter, leaving analysts nursing wounded egos. Even their loan business, apparently, is keeping people honest—well, honest enough.

So pour yourself a glass of vodka or two, and remember: In the world of finance, all things come back around—sometimes faster if you add a little blockchain.

- USD JPY 予想・見通し・の予想

- スーパーマン:クリプトを見る新しいDCUショートフィルムで一日を救う

- 『ウィッチャー』シーズン5が予想より早く登場

- Netflixの「モナコ殺人事件」は実話に基づいているのか?ストリーミングしたほうがいいですか?

- Death Among the Pines – リリースニュース

- ゼルダの伝説、今こそ必要な40周年記念の素晴らしいリリースを発表

- GBP JPY 予想・見通し・の予想

- 今週末観るのが待ちきれない、あまり知られていない Hulu 映画 3 本 (10 月 31 日~11 月 2 日)

- それはひどい考えです

- CNY JPY 予想・見通し・の予想

2025-06-25 23:12