Alright, folks, gather ‘round. So AAVE‘s doing a little dance—more like a belly flop than a graceful pirouette—dropping 23% since July. Yeah, the price is crashing like my hopes at a buffet, but the ecosystem? It’s doing cartwheels!

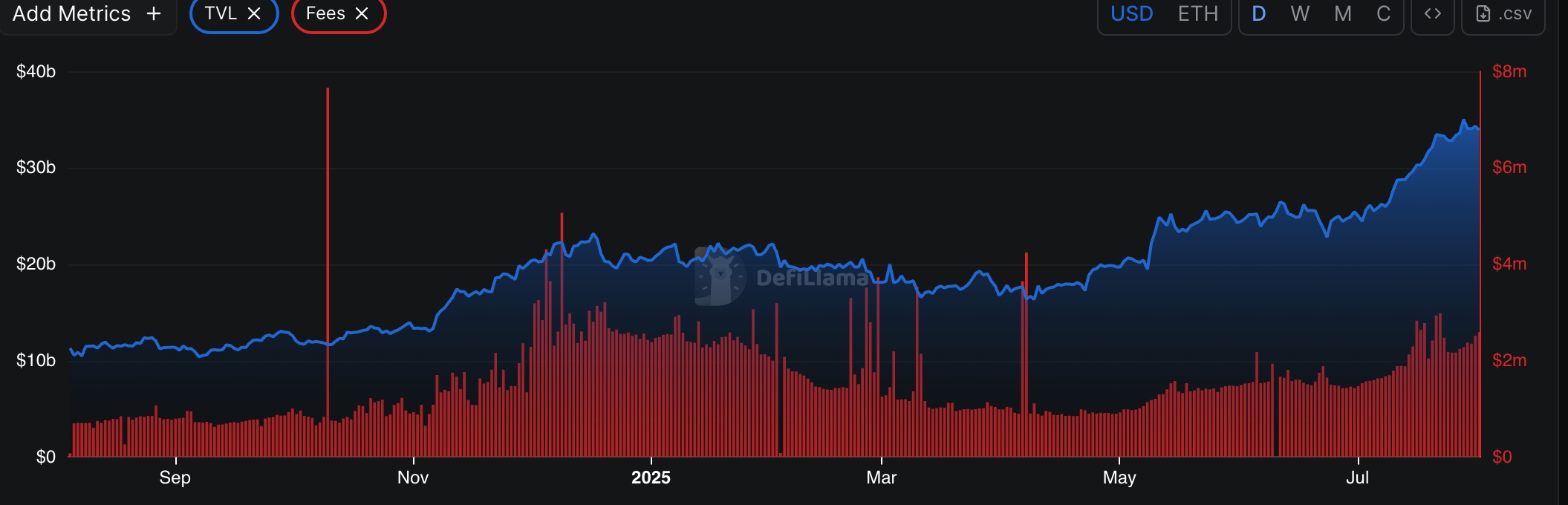

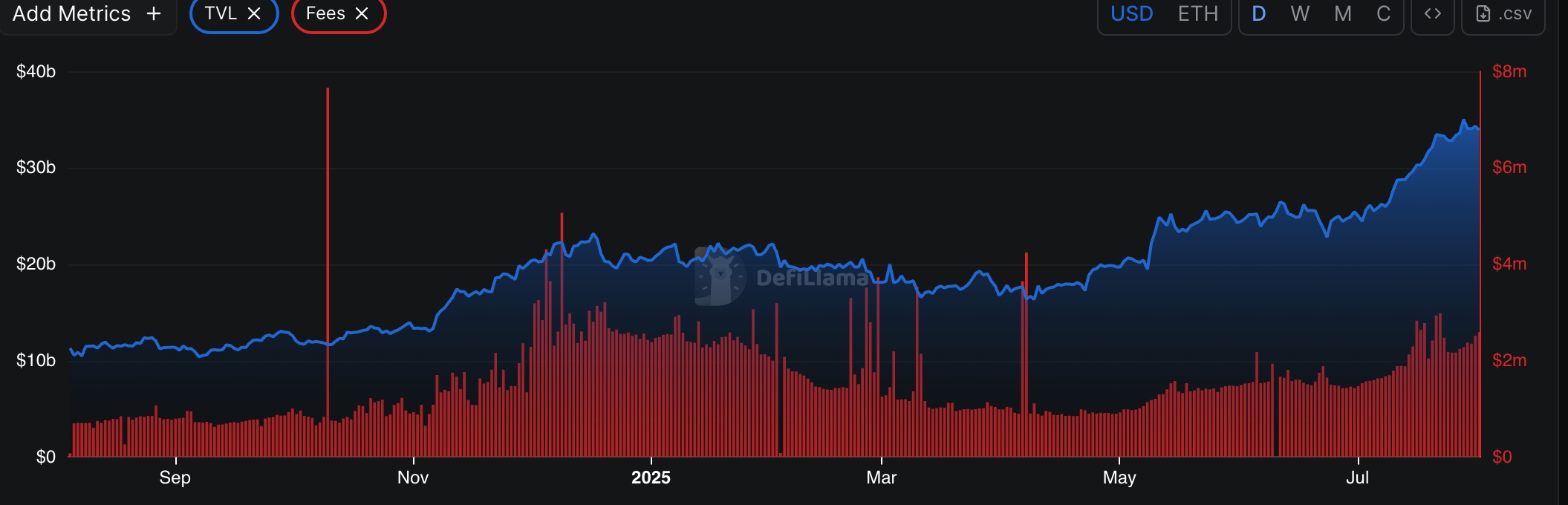

Now, hold onto your hats. Despite the slide, the total value locked is hitting a record—$35 billion! That’s more zeros than my bank account. Starting the year at $21 billion, so basically, they’re doing a magic trick—stuffing more assets into DeFi than I can hide snacks from my diet. And guess what? Ethena (ENA), the new kid on the block, just grew nearly $5 billion. That’s like putting a BOGO sale on digital assets.

Meanwhile, fees and revenue are skyrocketing. Over $783 million in fees in 12 months—that’s right, M-I-L-L-I-O-N. Their annual earnings? $47 million. Revenue? Over $110 million. I mean, if I could make that kind of cash without leaving my couch, I’d be doing handstands. Or at least a lazy wave.

TokenTerminal says deposits shot up 21% in July, active loans up by 25%—to a cool $20.5 billion. Monthly fees and revenue, like a rocket, up 49% and 85%. Basically, AAVE’s making bank, while its price is doing a “how low can you go” routine. The daily chart? A mess—peaked at $337.25, then took a nosedive faster than my New Year’s resolutions. It’s below the 50 and 100-day moving averages, lurking around the $250 line, like a kid hiding from chores. The RSI? Approaching “oversold,” so maybe it’s just tired or playing dead.

見て、あなたが罰のために大食いであるか、内部のスクープを手に入れない限り、これは古典的な「低い、多分」状況のように見えます。または、ご存知のように、傍観者から見て、何が起こっているのかを理解しているふりをしてください。何が起こっても、叔父の毎年恒例の魚の物語よりも面白いです。

- スーパーマン:クリプトを見る新しいDCUショートフィルムで一日を救う

- USD JPY 予想・見通し・の予想

- CNY JPY 予想・見通し・の予想

- Unseen Enemy(2025)映画レビュー

- ブリジット・バルドーの息子は誰ですか?彼らの複雑な関係について知っておくべきこと

- GBP JPY 予想・見通し・の予想

- プレデター:バッドランズの興行収入は、予想外に厳しい第2週の落ち込みにもかかわらず、OG映画の記録を破りました

- ダン・ダ・ダン第223章の発売日と感想読む場所

- 「ハドソンとレックス」のスターは、ハドソンがシーズン7にいない理由をようやく明らかにします

- DOGE 予想・見通し・の予想. DOGE 暗号通貨

2025-08-01 22:10